What is it?

It’s a growing field of financial and social innovation. In short, it is, “investment where specific social objectives are set and measured,” says Sir Ronald Cohen, chairman of the International Social Impact Investment Taskforce, formed at the G8 Social Impact Investment Forum in June 2013.

This is an important point: in order for impact investing to work, it needs to identify, measure and report the right social objectives and metrics. Why? Because impact is only achieved and investors will only earn interest on the basis of specific predefined outcomes being met (read more about the ins and outs of impact measurement on → here).

One of the aims of the International Social Impact Investment Taskforce is in fact to develop guidelines for impact measurement practice around the world. Its greater aim is to bring together government officials and senior G8-country figures in finance, business and philanthropy to collaboratively, “catalyse the development of the social impact investment market”. The very fact that such a taskforce exists reveals just how important this new market really is.

How big is the market?

It’s growing continuously, but in 2013, JP Morgan estimated it had already reached $46 billion. Interestingly, according to the Global Impact Investing Network (GIIN) and its Impact Reporting and Investment Standards (IRIS), sub-Saharan Africa made up 22% of global impact enterprises, also in 2013.

How big will it be?

Estimates (such as those by JP Morgan, Monitor Deloitte and the Calvert Foundation) range from $400 billion to $1 trillion in 2020.

Who’s doing it?

Actors in the impact investing industry

| Asset Owners | Asset Managers | Demand-Side Actors | Service Providers |

|---|---|---|---|

| High-net-worth individuals/families Corporations Governments Employees Retail investors Foundations | Investment advisors Fund managers Family offices Foundations Banks Corporations Venture funds Impact investment funds/intermediaries Pension funds Sovereign wealth funds Development institutions Government investment programmes | Corporations Small and growing businesses Social enterprises Cooperatives Micro-finance institutions Community development finance institutions | Networks Standards-setting bodies Consulting firms Non-governmental organisations Universities Capacity development providers Government programmes |

~ From “Accelerating Impact: Achievements, Challenges and What’s Next in Building the Impact Investing Industry” (2012), Rockefeller Foundation and E.T. Jackson

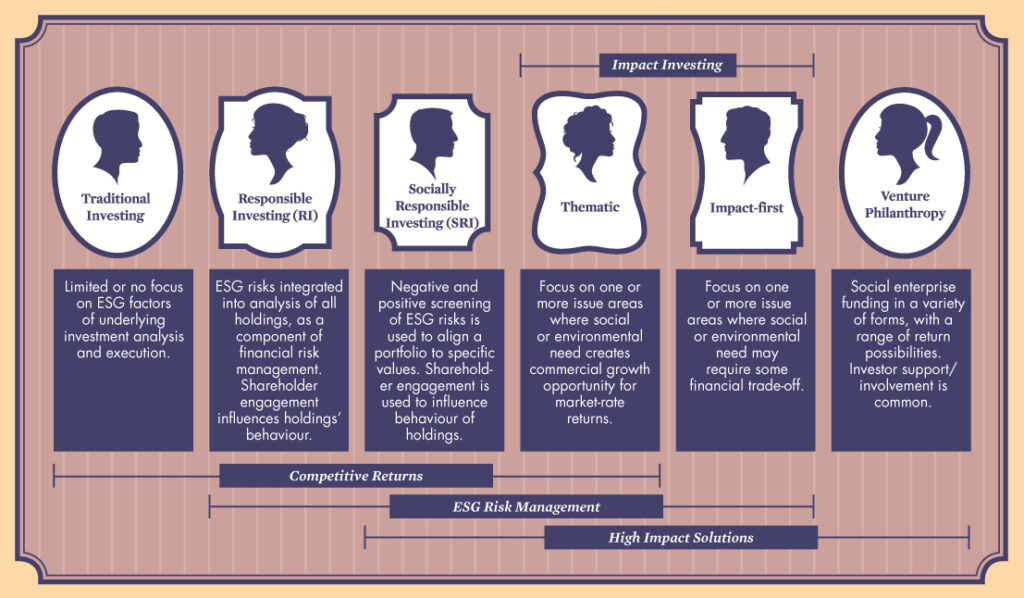

An Investment Family Portrait

Which ones prioritise what and how does impact investing fit into the tree?

~ Adapted from a Purpose Capital adaptation of Bridges Venture Research (2012). “The Power of Advice in the UK Sustainable Impact Investment Market”

Some misconceptions corrected

Impact investing is an asset class, right?

An asset class is a group of securities that all share similar financial characteristics and behaviours in the marketplace, plus they’re governed by the same regulations and laws. There are three main asset classes: equities (stocks), fixed-income (bonds) and cash equivalents (money-market instruments). But ever since the release of the groundbreaking report Impact Investments: An Emerging Asset Class by JP Morgan Social Finance in 2010, the idea of impact investing as a new asset class has captivated (and also perplexed) many investors.

Some argue that impact investments are separated from traditional asset classes by certain characteristics – such as a focus on Base of the Pyramid (BoP) consumers who are outside of traditional businesses, or activity in industries like Social Housing, which are uncorrelated to the market. In fact, impact investing refers to capital being distributed across sectors and asset classes (public and private debt, public and private equity, real assets, etc.). So, clearly, it is not an asset class. As the industry grows, it looks set to present progressively more options for impact investors within all asset classes that exist.

Impact investments are… “intended to create positive impact beyond financial returns.” ~ Impact Investments: An Emerging Asset Class (JP Morgan, GIIN and Rockefeller)

It has lower returns, doesn’t it?

Since the term “impact investing” was born, the idea of a trade-off – in the form of lower financial returns for higher social return – has been present in discussion and debate. But this trade-off is rooted less in fact than in fear. As an industry, we’re only just beginning to collect quantitative data supporting the idea that a company can be for-profit and for- purpose without making long-term sacrifices to either goal.

It’s only for wealthy investors…?

The truth is, small spenders are finding their way into impact investing through a number of paths. Surveys have shown that retail “investors” want to get involved and, slowly, more products are being rolled out that allow this to happen. Crowdfunding is available around the world and is a simple way for people to take small-equity stakes in start-ups and companies. Another option is the Calvert Foundation, a non-profit, microfinance fund in the US that uses an amassment of small-scale investments to lend money to social enterprises and non-profits in conservation, job-creation, affordable housing and other development fields. Their Community Investment Note is a debt security that allows people to contribute as little as $20 if invested online, and $1 000 if invested through director brokering.

It takes money away from grants…?

Impact investing doesn’t just shift grant money to investments. Rather, it seeks to increase the amount of capital directed towards creating positive social and environmental change. This means growth will result from investors moving from traditional investment products into impact investment products – for instance a mainstream investor shifting capital from a European private equity fund to an Asian microfinance fund. Growth will also come from the success of sustainable and impactful companies. Just as mainstream investors are looking at impact investing strategies throughout their portfolios, grant- based organisations are being encouraged to explore how they can use their endowment capital (the 95% that is traditionally managed) to expand their impact – a case of Total Portfolio Optimisation (see the definition → here).